Quick Guide to Lending Software Development: Cost, Timeline In 2025

Introduction: The Digital Transformation of Lending

The financial services industry stands at a pivotal crossroads where traditional lending practices meet cutting-edge digital innovation. The answer to why loan applications are approved in minutes instead of weeks lies in sophisticated lending software systems. Today’s lending landscape processes over $2 trillion in loans annually globally. Financial institutions embracing digital transformation report 40-60% efficiency gains. This shift reimagines access to capital, risk assessment, and customer service. The pandemic accelerated this, pushing traditional lenders to adopt digital-first strategies. In 2025, the question isn’t whether to digitize, but how to do it effectively while maintaining security, compliance, and trust.

What is Lending Software?

Definition and Core Concepts

Lending software is a comprehensive digital ecosystem automating the entire lending lifecycle. It acts as the digital backbone connecting borrowers with lenders. At its core, it encompasses loan origination systems (LOS), loan management systems (LMS), and supporting modules. These platforms leverage automation, data analytics, and intelligent workflows to create a seamless digital experience.

Evolution of Digital Lending Platforms

The journey from ledger books to sophisticated algorithms is significant. Early 2000s systems focused on record-keeping. Today, AI-powered platforms assess creditworthiness in seconds, predict default risks, and personalize offerings. Modern software incorporates machine learning, blockchain for security, and open banking APIs, democratizing credit access and enabling fintech competition.

Types and Use Cases of Lending Software

Consumer Lending Platforms

These serve individual borrowers, excelling at rapid decisions via credit scoring algorithms. They integrate with credit bureaus and banking networks for a frictionless experience, personalizing offerings based on financial profiles.

Business Lending Solutions

These address complex commercial financing needs, handling intricate workflows, multiple stakeholders, and sophisticated risk assessment models. They process diverse data types like financial statements and market projections.

Peer-to-Peer Lending Systems

P2P platforms connect individual lenders and borrowers via matching algorithms. They manage investor relations, risk distribution, payment processing, and compliance, orchestrating a complex financial ecosystem.

Mortgage and Real Estate Lending Software

This tackles complex consumer lending involving large amounts and extensive documentation. It integrates with property valuation, title services, and insurance providers, handling everything from pre-qualification to closing.

Also Read – Top 10 AI & Development Trends at GITEX 2025

Essential Features of Modern Lending Software Solutions

Core Functionality Components

Robust platforms feature loan origination, application processing, document management using OCR, workflow automation, and payment processing modules.

Advanced Features for Competitive Advantage

Cutting-edge platforms offer predictive analytics, real-time decision engines, CRM integration, mobile-first design, and API-first architecture for seamless third-party integration.

Step-by-Step Lending Software Development Process

Discovery and Requirements Analysis

This foundational phase involves deep dives into business objectives, target markets, regulations, and competition. Teams map user journeys and define technical requirements.

Design and Prototyping Phase

Design transforms requirements into tangible experiences through wireframes and mockups. Prototyping creates interactive demonstrations to validate concepts before development.

Development and Testing Cycles

Using agile methodologies, development occurs in sprints. Backend and frontend development proceed alongside quality assurance, including security and performance testing.

Deployment and Post-Launch Support

Deployment strategies vary (cloud, on-premise). Post-launch support includes bug fixes, optimization, and updates based on user feedback and evolving regulations.

Also Read – Launch a Loan Lending App MVP: Affordable Steps to Validate Your Idea

Cost Breakdown: Investment Analysis for Lending Software Development

Development Cost Factors

Costs depend on feature complexity, team composition, and regional rates. Basic platforms start around $150,000-$300,000, while enterprise solutions can exceed $2 million.

Lending Software Development Cost Breakdown by Component

| Component | Basic Platform | Advanced Platform | Enterprise Solution |

|---|---|---|---|

| Core Lending Module | $40,000-60,000 | $80,000-120,000 | $150,000-250,000 |

| Risk Assessment System | $20,000-30,000 | $50,000-80,000 | $100,000-180,000 |

| Integration Layer | $15,000-25,000 | $40,000-60,000 | $80,000-150,000 |

| Compliance Module | $25,000-35,000 | $60,000-90,000 | $120,000-200,000 |

| Analytics Dashboard | $15,000-20,000 | $35,000-50,000 | $70,000-120,000 |

| Mobile Applications | $30,000-40,000 | $60,000-90,000 | $100,000-180,000 |

| Security Infrastructure | $20,000-30,000 | $45,000-70,000 | $90,000-160,000 |

| Total Estimated Cost | $165,000-240,000 | $370,000-560,000 | $710,000-1,240,000 |

Regional Cost Variations

- North America: $150-250/hour; high quality, strong IP protection.

- Europe: $80-150/hour; balance of quality and cost-effectiveness.

- Asia: $25-120/hour; diverse options from cost-effective to premium.

Development Timeline: From Concept to Launch

- Discovery: 4-6 weeks

- Design & Prototyping: 6-8 weeks

- Core Development: 4-16 months (based on complexity)

- Testing & Integration: 6-10 weeks

- Deployment & Stabilization: 2-4 weeks

Development Timeline by Platform Complexity

| Development Phase | Basic Platform | Advanced Platform | Enterprise Solution |

|---|---|---|---|

| Discovery & Planning | 3-4 weeks | 4-6 weeks | 6-8 weeks |

| Design & Prototyping | 4-6 weeks | 6-8 weeks | 8-12 weeks |

| Core Development | 16-20 weeks | 28-36 weeks | 48-64 weeks |

| Integration & Testing | 4-6 weeks | 8-10 weeks | 12-16 weeks |

| Deployment & Launch | 2-3 weeks | 3-4 weeks | 4-6 weeks |

| Total Timeline | 29-39 weeks | 49-64 weeks | 78-106 weeks |

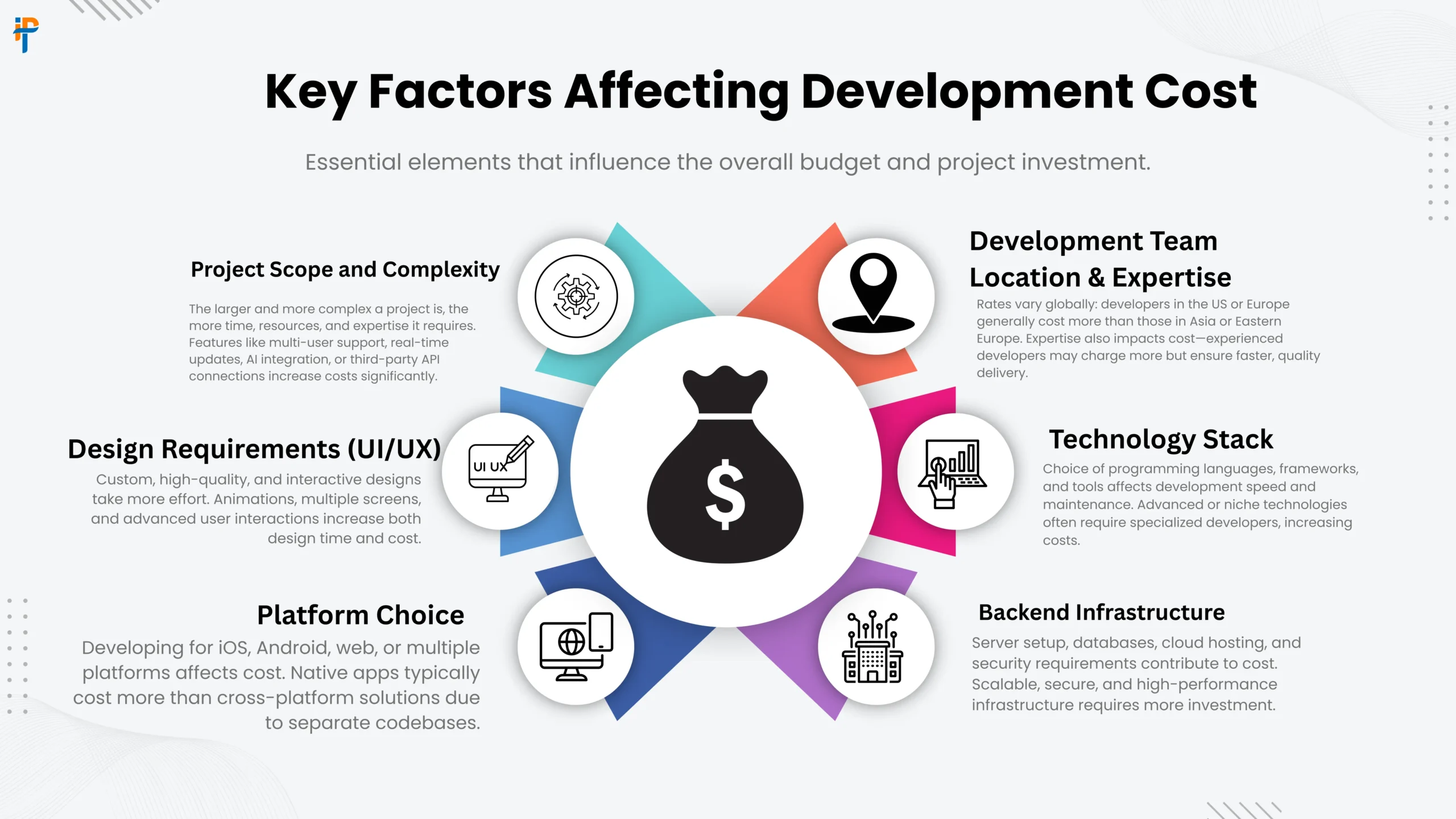

Key Factors Affecting Development Cost and Timeline

Technical Complexity Considerations

Microservices add 20-30% to costs but offer scalability. Machine learning models can double analytical costs but deliver superior capabilities.

Integration Requirements

Each third-party integration (credit bureaus, banking networks) adds complexity and cost. Legacy system integration poses particular challenges.

Scalability Planning

Building for scale (e.g., using Kubernetes) increases initial costs by 10-15% but prevents expensive re-architecture later. Investing in performance engineering is crucial.

Technology Stack: Choosing the Right Tools and Frameworks

Frontend Technologies

React and Angular dominate enterprise apps. Vue.js is a lighter alternative. Progressive Web Apps (PWAs) deliver app-like experiences via browsers.

Backend Infrastructure

Java/Spring Boot and .NET Core are enterprise staples. Node.js enables full-stack JavaScript. Python excels for analytics/ML. Go offers high performance.

Database Solutions

SQL databases (PostgreSQL, MySQL) ensure transactional integrity. NoSQL (MongoDB) offers flexibility for unstructured data. A polyglot persistence strategy is often best.

Benefits of Custom Lending Software for Financial Institutions

Operational Efficiency Gains

Automation streamlines workflows, processing 3-4 times more applications. It reduces operational costs, prevents compliance violations, and cuts fraud losses.

Enhanced Customer Experience

Software delivers intuitive, mobile-accessible interfaces with rapid decisions. Personalization improves conversion rates and customer lifetime value.

Competitive Market Positioning

Custom solutions enable unique value propositions and agility to respond to market changes, providing a significant competitive moat.

Compliance & Security Deep Dive: Regulatory Frameworks Across Markets

Global Regulatory Requirements

Platforms must navigate TILA, ECOA, FCRA, and AML in the US; GDPR, PSD2 in Europe. Multi-jurisdictional operations require flexible architectures.

Security Best Practices

Data Encryption: AES-256 for data at rest, TLS 1.3 for data in transit, using HSMs for key management.

Authentication: Multi-factor authentication (MFA), adaptive authentication, and single sign-on (SSO) are essential.

Also Read – How to Patent a Mobile App: The Complete Step-by-Step Guide in 2025

AI/ML Integration in Modern Lending Software

Credit Scoring Algorithms

ML models analyze thousands of variables (including alternative data) for 15-25% better accuracy than traditional models, useful for thin-file borrowers.

Fraud Detection Systems

Anomaly detection algorithms identify suspicious patterns. Behavioral biometrics analyzes user behavior for passive authentication, achieving >95% detection rates.

Automated Decision Making

ML optimizes approval thresholds dynamically. NLP and computer vision automate document analysis and verification, enabling straight-through processing.

Future Trends in Lending Software Development

Emerging trends include blockchain for audit trails, DeFi protocols, open banking for better data access, embedded finance, voice interfaces, and quantum computing. ESG considerations are increasingly influential.

Ready to Build Your Competitive Lending Platform in 2025?

The future of lending is digital, and the time to act is now. As we’ve explored, a custom lending solution is not just a software project—it’s a strategic investment that can redefine your operational efficiency, customer experience, and market position.

Navigating the complexities of development—from cost and timeline to compliance and AI integration—requires a partner with deep expertise and a proven track record.

Why Choose IPH Technologies as Your Development Partner?

At IPH Technologies, we don’t just build software; we build strategic financial solutions. Our team is equipped to guide you through every step of the journey, ensuring your platform is secure, scalable, and designed for success in 2025 and beyond.

Proven Expertise in FinTech: With a deep understanding of regulatory frameworks (GDPR, PSD2, TILA, AML) and security best practices, we build compliance into the core of your platform.

Cutting-Edge Technology: We leverage the latest in AI/ML for credit scoring and fraud detection, blockchain for security, and microservices architecture for unparalleled scalability.

End-to-End Development: From the initial discovery phase to deployment and ongoing support, we provide a seamless, transparent development process tailored to your business goals.

Take the First Step Today.

Let’s transform your lending operations and capture new market opportunities. Explore our past work to see our capabilities in action, and then contact us for a personalized consultation.

Explore Our Portfolio: See how we’ve helped other financial institutions innovate and succeed. View Our Portfolio

Contact Us for a Free Consultation: Discuss your project vision, get a preliminary assessment, and receive a tailored roadmap and estimate. Get in Touch Today

Don’t just adapt to the future of lending—define it with IPH Technologies.

Conclusion

Lending software development is a complex but rewarding endeavor combining technology and finance. Success requires planning, investment, and continuous improvement. The rewards—efficiency, advantage, and customer experience—are substantial. The future belongs to lenders who embrace thoughtful digital transformation, using custom software as a foundation for growth.

FAQ

What is lending software?

What are the main types of lending software?

- Consumer lending platforms: For individual borrowers, offering fast decisions through credit scoring.

- Business lending solutions: Handles complex commercial financing with multiple stakeholders.

- Peer-to-peer (P2P) platforms: Connect individual borrowers and lenders using matching algorithms.

- Mortgage & real estate software: Manages large loans, property valuations, title services, and closing processes.

What features are essential in modern lending software?

How long does it take to develop lending software?

- Basic platforms: 29–39 weeks

- Advanced platforms: 49–64 weeks

- Enterprise solutions: 78–106 weeks

What factors influence the cost of lending software development?

Which technology stacks are commonly used?

- Frontend: React, Angular, Vue.js, PWAs

- Backend: Java/Spring Boot, .NET Core, Node.js, Python, Go

- Database: SQL (PostgreSQL, MySQL), NoSQL (MongoDB), or polyglot persistence

How does lending software improve operational efficiency?

How does AI/ML enhance lending software?

- Credit scoring with alternative data improves accuracy.

- Fraud detection uses anomaly detection and behavioral biometrics.

- Automated document verification via NLP and computer vision enables straight-through processing.

How does lending software ensure compliance and security?

- Regulatory frameworks include TILA, ECOA, FCRA, AML (US) and GDPR, PSD2 (Europe).

- Security best practices: AES-256 encryption, TLS 1.3, HSM key management, MFA, SSO, and adaptive authentication.

.png)