Introduction: Why MVPs Matter in Fintech

Have you ever wondered why 90% of fintech startups fail within their first year? The answer often lies in overbuilding before validating. In the competitive world of digital lending, launching with a Minimum Viable Product (MVP) isn’t just smart—it’s essential for survival. Think of it like testing the waters before diving into the deep end of the pool.

The fintech lending market is experiencing unprecedented growth, with digital lending platforms expected to reach a market value of $20.5 billion by 2026. Yet, many entrepreneurs make the costly mistake of trying to build the perfect lending app from day one, burning through capital before proving their concept works. That’s where an MVP for loan lending apps becomes your secret weapon—allowing you to validate your innovative lending solution without breaking the bank.

Understanding MVP in the Context of Loan Lending Apps

What Makes a Lending App MVP Different

Creating an MVP for loan lending apps isn’t like building a simple e-commerce platform. You’re dealing with people’s financial lives, regulatory requirements, and the need for robust security from day one. It’s like building a house—you need a solid foundation even if you’re starting with just the essential rooms.

The unique challenge of lending app MVPs lies in balancing minimal features with mandatory compliance and security requirements. Unlike other apps where you can launch with basic functionality, lending apps must incorporate certain non-negotiable elements like secure data handling, basic credit assessment capabilities, and regulatory compliance features. These requirements make the MVP development process more complex but also more crucial for long-term success.

Core vs. Nice-to-Have Features

When developing your MVP for loan lending apps, distinguishing between essential and optional features can make or break your budget. Core features are those without which your lending app simply cannot function or meet basic user expectations. Nice-to-have features, while potentially valuable, can wait until you’ve validated your core concept and secured additional funding.

The key is understanding what your target users absolutely need versus what would merely delight them. For instance, while AI-powered credit scoring might sound impressive, a simpler rule-based system might suffice for your MVP phase. Remember, you’re not trying to compete with established players feature-for-feature; you’re trying to prove your unique value proposition works.

Also Read – AI App Development Cost in 2025: From MVPs to Full-Scale Solutions

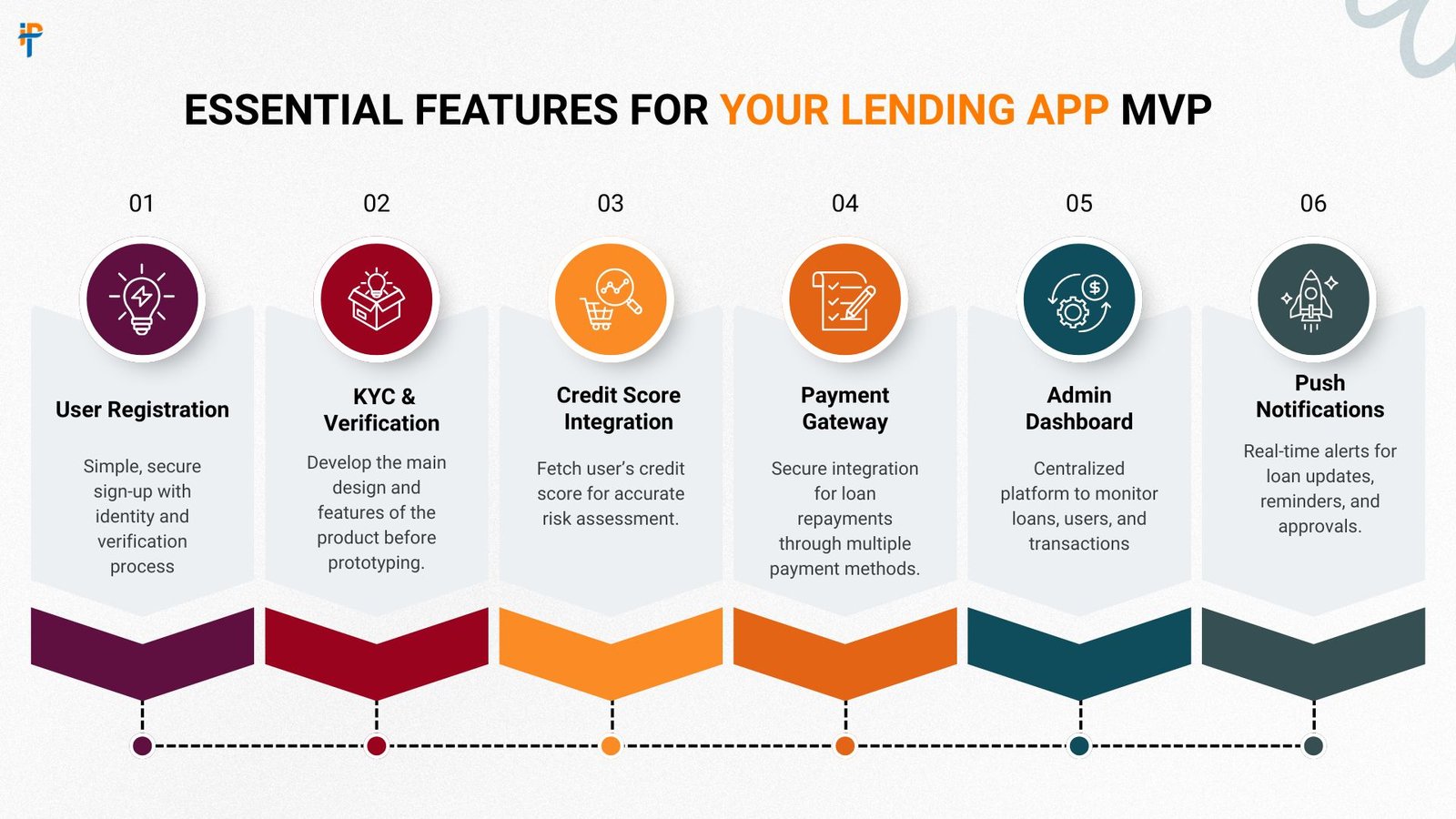

Essential Features for Your Lending App MVP

User Authentication and KYC

Security isn’t optional when you’re handling financial transactions. Your MVP must include robust user authentication and Know Your Customer (KYC) processes. This doesn’t mean building everything from scratch—leveraging third-party identity verification services can save months of development time and thousands of dollars.

Modern KYC solutions offer API integrations that can verify user identities within seconds, checking government databases, validating documents, and even performing facial recognition. By incorporating these pre-built solutions, you’re not just saving money; you’re also ensuring compliance with anti-money laundering (AML) regulations from the start. Think of it as renting a security system instead of building your own from scratch—equally effective but far more affordable.

Loan Application Process

The loan application flow is the heart of your MVP for loan lending apps. This process needs to be intuitive enough that users can complete it without assistance, yet comprehensive enough to gather all necessary information for credit decisions. Start with a streamlined application that captures essential data: personal information, employment details, loan amount, and purpose.

Consider implementing a progressive disclosure approach—asking for information in stages rather than overwhelming users with a lengthy form upfront. This approach not only improves user experience but also allows you to capture partial data from users who might abandon a longer form. Every abandoned application is a learning opportunity, telling you where your process might be too complex or demanding.

Credit Assessment Engine

Your credit assessment capability doesn’t need to rival sophisticated machine learning models used by major banks—at least not initially. For your MVP, focus on creating a reliable, rule-based scoring system that can make consistent lending decisions based on key criteria. This might include credit score thresholds, debt-to-income ratios, and employment verification.

Many successful lending app MVPs start with conservative lending criteria, approving only the most qualified applicants. This approach minimizes risk while you gather data to refine your credit models. As you accumulate performance data on your loans, you can gradually sophisticate your assessment criteria, potentially incorporating alternative data sources or more complex algorithms.

Payment Processing System

The ability to disburse loans and collect repayments is fundamental to any lending operation. Your MVP should include integrated payment processing that supports both ACH transfers for loan disbursement and automated repayment collection. This is another area where third-party services can dramatically reduce development complexity and costs.

Technical Architecture for Cost-Effective Development

Choosing the Right Tech Stack

Your technology choices can significantly impact both initial development costs and long-term scalability. For an MVP for loan lending apps, consider using established frameworks and languages that offer extensive libraries and community support. Popular choices include Node.js or Python for backend development, React Native or Flutter for cross-platform mobile apps, and PostgreSQL or MongoDB for databases.

The beauty of modern development

frameworks is their modularity—you can start simple and add complexity as needed. Don’t feel pressured to use cutting-edge technology just because it’s trendy. Sometimes, boring technology choices are the smartest ones, offering stability, extensive documentation, and a large pool of developers who can work with them.

Cloud Infrastructure Options

Cloud platforms have revolutionized how startups can launch technology products affordably. Services like AWS, Google Cloud, or Microsoft Azure offer pay-as-you-go pricing models perfect for MVPs with uncertain initial traffic. You might spend just hundreds of dollars monthly during your early stages, scaling up infrastructure only as your user base grows.

Consider using Platform-as-a-Service (PaaS) solutions like Heroku or Google App Engine for even simpler deployment and management. These platforms handle much of the infrastructure complexity, letting you focus on building features rather than managing servers. It’s like the difference between buying a car and using a ride-sharing service—both get you where you need to go, but one requires significantly less upfront investment and maintenance.

Third-Party Integrations vs. Custom Development

The build-versus-buy decision is crucial when developing your MVP for loan lending apps. Modern fintech infrastructure providers offer plug-and-play solutions for everything from identity verification to payment processing, credit bureau integration, and even loan management systems. These services typically charge on a per-transaction basis, making them extremely cost-effective for early-stage startups.

Build vs. Buy Comparison for Key Features

| Feature | Custom Build Cost | Third-Party Solution Cost | Time to Implement (Custom) | Time to Implement (Third-Party) |

|---|---|---|---|---|

| KYC/Identity Verification | $50,000-$100,000 | $0.50-$3 per verification | 3-6 months | 1-2 weeks |

| Payment Processing | $30,000-$75,000 | 2.9% + $0.30 per transaction | 2-4 months | 3-5 days |

| Credit Bureau Integration | $25,000-$50,000 | $0.25-$1 per credit pull | 2-3 months | 1 week |

| SMS/Email Notifications | $5,000-$15,000 | $0.01-$0.10 per message | 2-3 weeks | 1-2 days |

| Document Storage/Management | $20,000-$40,000 | $0.02-$0.10 per GB | 1-2 months | 3-5 days |

Regulatory Compliance on a Budget

Essential Compliance Requirements

Navigating the regulatory landscape is perhaps the most daunting aspect of launching a lending app. Depending on your location and target market, you’ll need to comply with various regulations including Truth in Lending Act (TILA), Fair Credit Reporting Act (FCRA), and state-specific lending laws. Don’t let this overwhelm you—many successful lending startups began by focusing on a single state or working with lending partners who already hold necessary licenses.

The key is understanding which regulations apply to your specific model. Are you originating loans directly, or are you connecting borrowers with lenders? Different models have different regulatory requirements, and choosing the right approach can significantly impact your compliance costs and timeline to market.

Cost-Effective Compliance Strategies

Instead of trying to obtain lending licenses in multiple states immediately, consider partnering with licensed lenders or using a loan brokering model for your MVP. This approach, often called the “marketplace model,” allows you to validate your technology and user acquisition strategies without the heavy regulatory burden of direct lending.

Another strategy is to start in states with more favorable lending regulations. Some states have more straightforward licensing processes and lower regulatory barriers, making them ideal testing grounds for your MVP. Once you’ve proven your model in these initial markets, you can use your traction and revenue to fund expansion into more regulated territories.

Also Read – How to Patent a Mobile App: Step-by-Step Legal Guide

Building Your MVP: Step-by-Step Process

Market Research and Validation

Before writing a single line of code, invest time in understanding your target market deeply. Who are your ideal borrowers? What pain points do existing lending solutions fail to address? Conduct surveys, interviews, and analyze competitor offerings to identify gaps in the market. This research phase might feel slow, but it’s like aiming before shooting—it dramatically increases your chances of hitting the target.

Create user personas that represent your different customer segments. Are you targeting young professionals needing emergency funds, small business owners seeking working capital, or students looking for education loans? Each segment has unique needs, and your MVP should focus on serving one segment exceptionally well rather than trying to please everyone moderately.

Prototype Development

Start with low-fidelity prototypes—even paper sketches or simple wireframes can help validate your user flow before investing in development. Tools like Figma or Adobe XD allow you to create interactive prototypes that feel like real apps without any coding. Use these prototypes to gather feedback from potential users, iterating on your design before committing to development.

When you’re ready to build, consider using a phased approach. Begin with a web application before developing native mobile apps—web apps are generally faster and cheaper to develop and update. You can always add mobile apps once you’ve validated demand and refined your user experience.

Testing and Iteration

Testing your MVP for loan lending apps isn’t just about finding bugs—it’s about validating your entire business hypothesis. Start with a small beta group, perhaps 50-100 users, and closely monitor their behavior. Are they completing loan applications? What’s causing drop-offs? How long does it take them to complete key tasks?

Implement comprehensive analytics from day one. Tools like Mixpanel or Amplitude can track user behavior in detail, providing insights that guide your iteration process. Remember, your MVP is a learning tool—every user interaction teaches you something about what works and what doesn’t.

Cost Breakdown and Budget Planning

Let’s talk numbers—because understanding costs upfront can save you from painful surprises later. Developing an MVP for loan lending apps typically requires an investment between $50,000 and $200,000, depending on your approach and feature complexity. This might sound daunting, but remember, this is significantly less than the millions traditional financial institutions spend on technology development.

Typical MVP Development Cost Breakdown

| Category | Low-End Estimate | High-End Estimate | Percentage of Total Budget |

|---|---|---|---|

| Development Team (3-6 months) | $30,000 | $100,000 | 40-50% |

| Third-Party Service Integration | $5,000 | $15,000 | 5-10% |

| Compliance and Legal | $10,000 | $35,000 | 15-20% |

| Cloud Infrastructure (6 months) | $1,000 | $5,000 | 2-3% |

| Design and UX | $5,000 | $20,000 | 8-12% |

| Marketing and User Acquisition | $5,000 | $25,000 | 10-15% |

| Security Audits and Testing | $3,000 | $10,000 | 5-7% |

| Contingency Fund | $5,000 | $15,000 | 10% |

Monetization Strategies for Early Stage

Your MVP needs a clear path to revenue, even if profitability isn’t immediate. The most straightforward monetization model for lending apps is the interest rate spread—charging borrowers a higher rate than your cost of capital. However, during the MVP phase, consider additional revenue streams like origination fees, late payment fees, or premium features for faster loan processing.

Some successful lending app MVPs have started with a freemium model, offering basic loan matching services for free while charging for premium features like instant approval or lower rates. This approach can help you build a user base quickly while still generating some revenue to reinvest in product development.

User Acquisition and Growth Hacking

Acquiring your first users is often the hardest challenge for any MVP. For loan lending apps, trust is paramount—people need to feel confident sharing their financial information with a new platform. Start by leveraging your personal network and targeting communities where you have credibility. Online communities, professional associations, and social media groups can be goldmines for early adopters.

Consider implementing a referral program from day one. Financial services have some of the highest customer lifetime values, justifying generous referral bonuses. Dropbox famously grew through referrals, and many successful lending apps have followed suit, offering cash bonuses or rate discounts for successful referrals.

Common Pitfalls to Avoid

The road to launching an MVP for loan lending apps is littered with potential pitfalls. One of the biggest mistakes is over-engineering your solution before validating market demand. Just because you can build a feature doesn’t mean you should—at least not in your MVP. Stay laser-focused on your core value proposition and resist the temptation to add “just one more feature.”

Another common error is underestimating the importance of user experience. While your MVP doesn’t need to be perfect, it needs to be good enough that users can complete their intended tasks without frustration. A clunky interface or confusing flow can kill your validation efforts before you truly test your business model.

Don’t neglect security and compliance, even in your eagerness to launch quickly. A data breach or regulatory violation can destroy your startup before it really begins. Build security and compliance into your development process from the start, rather than treating them as afterthoughts.

Scaling from MVP to Full Product

Success with your MVP is just the beginning of your journey. As you validate your concept and start generating revenue, you’ll need to plan for scaling. This doesn’t mean immediately adding every feature on your wishlist—it means strategically expanding based on user feedback and data-driven insights.

Your scaling strategy should focus on three key areas: technology infrastructure, team building, and geographic expansion. On the technology front, you might need to refactor some of your MVP’s quick-and-dirty solutions to handle increased load. Team-wise, you’ll likely need to hire specialists in areas like risk management, compliance, and customer service. Geographic expansion should be methodical, moving into new markets only after establishing strong operations in your initial territory.

Case Studies and Success Stories

Looking at successful examples can provide valuable insights for your own MVP journey. Companies like Affirm started with a focused MVP targeting specific e-commerce partnerships before expanding into a full-featured lending platform. Their initial product was remarkably simple—offering point-of-sale loans for online purchases—but it proved the concept and attracted both users and investors.

Another inspiring example is Kabbage, which began by focusing exclusively on small business loans using innovative data sources for credit decisions. Their MVP leveraged existing business data from platforms like QuickBooks and eBay to make rapid lending decisions, proving that alternative credit scoring methods could work. This focused approach helped them raise funding and eventually led to their acquisition by American Express for a reported $850 million.

Case Studies and Success Stories

Looking at successful examples can provide valuable insights for your own MVP journey. Companies like Affirm started with a focused MVP targeting specific e-commerce partnerships before expanding into a full-featured lending platform. Their initial product was remarkably simple—offering point-of-sale loans for online purchases—but it proved the concept and attracted both users and investors.

Another inspiring example is Kabbage, which began by focusing exclusively on small business loans using innovative data sources for credit decisions. Their MVP leveraged existing business data from platforms like QuickBooks and eBay to make rapid lending decisions, proving that alternative credit scoring methods could work. This focused approach helped them raise funding and eventually led to their acquisition by American Express for a reported $850 million.

Future-Proofing Your Lending App

While your MVP should focus on immediate validation, it’s wise to consider future trends in fintech and digital lending. Artificial intelligence and machine learning are becoming increasingly important for credit decisioning and fraud detection. Building your MVP with modular architecture allows you to incorporate these advanced technologies as you scale.

Open banking regulations are creating new opportunities for lending apps to access customer financial data with consent. Consider how your MVP might leverage these capabilities in the future, even if you don’t implement them initially.

Blockchain technology and decentralized finance (DeFi) are also emerging trends worth monitoring, though they may not be suitable for your MVP stage.

Measuring Success: KPIs and Metrics

You can’t improve what you don’t measure, and this is especially true for lending app MVPs. Key performance indicators should span the entire user journey, from acquisition to repayment. Critical metrics include application completion rate, approval rate, default rate, customer acquisition cost (CAC), and lifetime value (LTV).

During your MVP phase, focus on leading indicators that predict long-term success rather than just vanity metrics. For instance, user engagement and repeat usage might be more important than total downloads. The speed at which users complete loan applications and their likelihood to recommend your service (Net Promoter Score) can indicate product-market fit better than raw user numbers.

Track cohort performance religiously—understanding how different user groups behave over time helps you refine your credit models and marketing strategies. Modern analytics tools make it easier than ever to segment users and track their journey through your lending funnel, providing insights that guide both product development and business strategy.

Also Read- How Much Does It Cost to Hire an App Developer in Dubai 2025

Conclusion

Launching an MVP for loan lending apps is a challenging but rewarding journey that requires careful balance between speed and compliance, innovation and reliability. By focusing on core features, leveraging third-party services, and maintaining a laser focus on user validation, you can bring your lending app to market affordably while minimizing risk.

Remember, your MVP isn’t meant to be perfect—it’s meant to be good enough to test your hypotheses and learn from real users. Every successful lending platform started somewhere, often with far fewer features and resources than they have today. What matters is starting, learning, and iterating based on real market feedback.

The digital lending revolution is still in its early stages, with enormous opportunities for innovative solutions that address underserved markets or offer better user experiences. By following the strategies outlined in this guide, you’re positioning yourself to validate your idea efficiently, attract investors, and build a sustainable lending business that makes a real difference in people’s financial lives.

Your MVP for loan lending apps is more than just a product—it’s a learning laboratory that will teach you invaluable lessons about your market, your users, and your business model. Embrace the journey, stay focused on your core mission, and remember that today’s simple MVP could be tomorrow’s fintech unicorn.

.png)