Introduction The Growing Demand for Online Earning Apps in UAE 2026

Have you ever wondered why everyone seems to be talking about online earning apps these days? Well, you’re not alone. The United Arab Emirates is experiencing an unprecedented surge in demand for digital platforms that help people generate income from their smartphones. From busy professionals looking for side hustles to students seeking flexible earning opportunities, the UAE market is ripe with potential for innovative online earning applications.

The landscape of work is changing rapidly, and the UAE stands at the forefront of this digital revolution. With one of the highest internet penetration rates globally, reaching approximately 96% of the population, the Emirates provide fertile ground for app-based earning platforms. This isn’t just a passing trend; it’s a fundamental shift in how people approach income generation in the modern economy.

The convergence of advanced technology infrastructure, progressive government policies, and a diverse, ambitious population has created the perfect storm for online earning apps to flourish. Whether you’re an entrepreneur looking to launch the next big earning platform or a business seeking to tap into this growing market, understanding the nuances of app development in the UAE context is crucial for success.

Why Online Earning Apps Are Thriving in the UAE Market

Digital Transformation in the Middle East

The UAE government’s vision for digital transformation has created an ecosystem where technology-driven solutions flourish. The nation aims to double its digital economy contribution to GDP, with ambitious initiatives supporting smart cities, cashless transactions, and digital-first government services. This ambitious roadmap has opened doors for innovative app developers and entrepreneurs to create platforms that empower citizens and residents to earn money online.

Think of the UAE as a digital playground where innovation meets opportunity. The government’s progressive policies, coupled with world-class infrastructure, have transformed cities like Dubai and Abu Dhabi into global tech hubs. Free zones like Dubai Internet City and Abu Dhabi’s Hub71 provide entrepreneurs with streamlined business setup, tax benefits, and access to venture capital. This environment doesn’t just support online earning apps—it actively encourages them.

High Smartphone Penetration and Tech-Savvy Population

With smartphone penetration exceeding 98% among the UAE population, nearly everyone has a powerful earning tool right in their pocket. The average UAE resident spends over 7 hours daily on their mobile devices, creating countless opportunities for app-based earning activities. This tech-savvy demographic isn’t just comfortable with digital transactions—they expect seamless, intuitive experiences that traditional earning methods simply can’t provide.

The UAE boasts one of the youngest populations in the region, with a median age around 33 years. This digitally native demographic grew up with smartphones and expects everything to be accessible through an app. They’re comfortable with concepts like gig work, cryptocurrency trading, and remote freelancing in ways that previous generations simply weren’t.

Growing Gig Economy and Side Hustles

The gig economy in the UAE has exploded, with platforms enabling everything from freelance graphic design to food delivery services. Approximately 30% of UAE’s workforce now participates in some form of gig work or side hustle. This cultural shift toward flexible earning arrangements has created massive demand for reliable, user-friendly online earning platforms.

What’s driving this trend? Several factors converge: the high cost of living in major emirates motivating people to supplement primary incomes, expatriates seeking to maximize earnings during their time in the UAE, entrepreneurs testing business ideas with minimal overhead, and professionals building personal brands and client bases for eventual independence. The traditional 9-to-5 job is no longer the only path to financial success—online earning apps have democratized opportunity.

Also read – Top 7 Digital Transformation Technologies Revolutionizing Business Operations

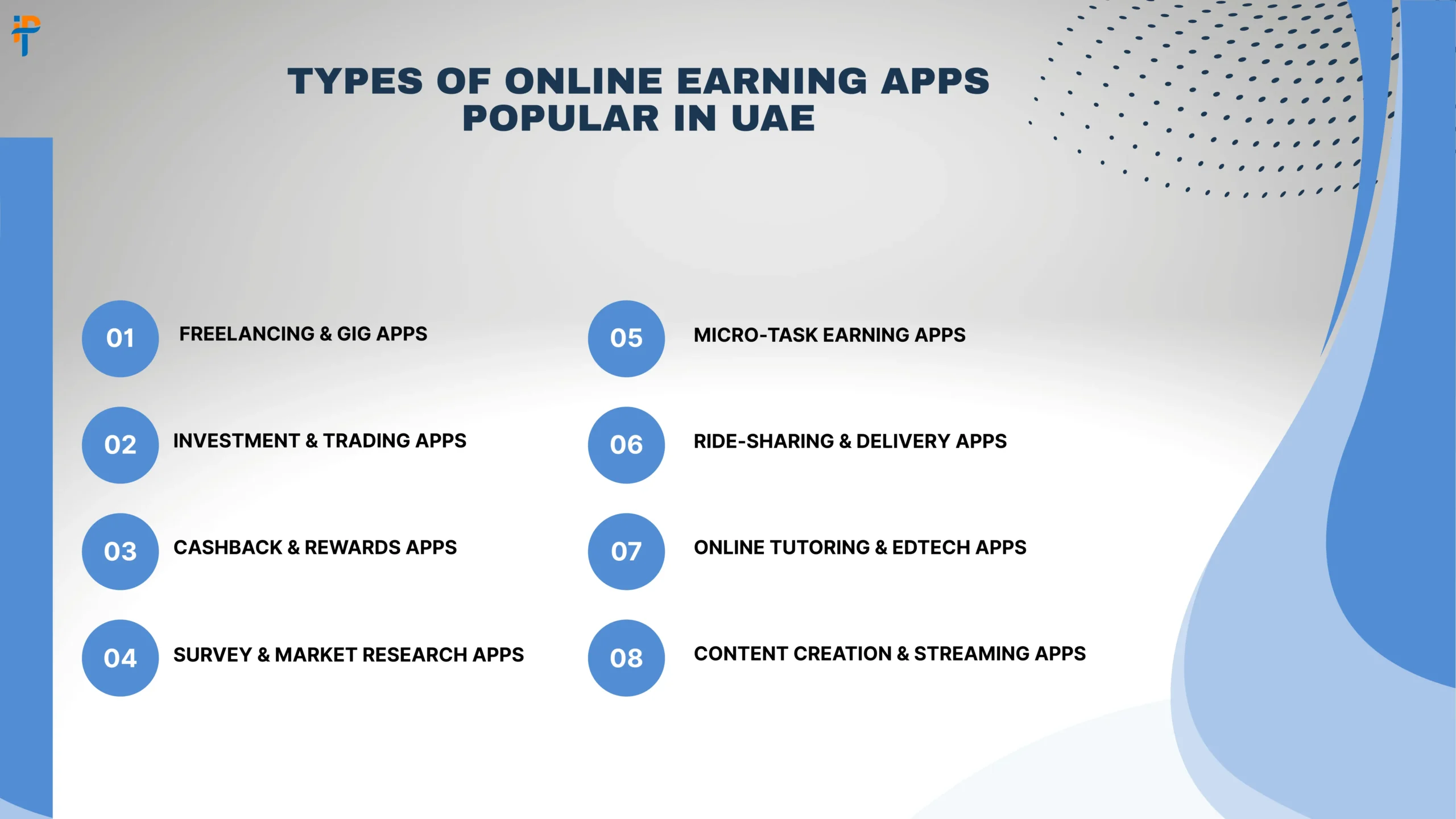

Types of Online Earning Apps Popular in UAE

Freelance and Gig Economy Apps

Freelance platforms dominate the UAE’s online earning landscape. These apps connect skilled professionals with clients seeking specific services—from content writing and graphic design to software development and digital marketing. Popular categories include creative services, technical consulting, administrative support, translation services, and digital marketing.

What makes these platforms particularly attractive in the UAE? It’s the perfect marriage of high-skilled expatriate workforce and global client access. A developer in Dubai can seamlessly work with a startup in Silicon Valley, all through a single app interface. The UAE’s strategic time zone position—bridging East and West—makes freelancers available during prime business hours for both Asian and European clients.

Investment and Trading Platforms

The UAE’s position as a global financial center has spawned numerous investment-focused earning apps. These platforms allow users to trade stocks, cryptocurrencies, commodities, and forex—all from their smartphones. With robust regulatory oversight from entities like the Dubai Financial Services Authority, users can trade with confidence while building their investment portfolios.

Investment apps in the UAE cater to various experience levels, from beginners using robo-advisors and automated portfolio management to experienced traders utilizing advanced charting tools and algorithmic trading features. The growing interest in cryptocurrency has also driven demand for crypto trading platforms that comply with UAE regulations while offering access to global digital asset markets.

Cashback and Rewards Apps

Who doesn’t love getting money back on purchases they’re already making? Cashback apps have gained tremendous traction in the UAE market, offering users percentages back on everything from groceries to travel bookings. These apps partner with retailers to create win-win situations where consumers save money while merchants drive sales.

The UAE’s consumer market is particularly receptive to loyalty and rewards programs. With high disposable incomes and a culture that values premium shopping experiences, cashback apps that offer 5-25% returns on luxury goods, dining, and entertainment see exceptional engagement rates. Many platforms have evolved beyond simple cashback to offer comprehensive rewards ecosystems with points, tier-based benefits, and exclusive member perks.

Survey and Task-Based Apps

Micro-Task Applications

Micro-task apps let users earn small amounts of money by completing simple activities like data entry, image tagging, content moderation, translation snippets, and audio transcription. While individual tasks may pay modestly—typically ranging from AED 2 to AED 50 per task—the cumulative earnings can be substantial for dedicated users.

These platforms work particularly well in the UAE because they accommodate the busy lifestyles of residents. Someone commuting on the Dubai Metro can complete three or four tasks during their journey, turning otherwise idle time into productive earning opportunities. The flexibility to work whenever and wherever suits the UAE’s fast-paced lifestyle perfectly.

Opinion and Market Research Platforms

Companies desperately need consumer insights, and they’re willing to pay for them. Survey apps connect UAE residents with brands seeking authentic feedback on products, services, and marketing campaigns. It’s a straightforward value exchange—your opinion for cash or gift cards.

The UAE presents a unique market research opportunity because of its incredibly diverse population representing over 200 nationalities. Brands testing products for global markets highly value feedback from this multicultural demographic. Survey apps capitalize on this by offering premium rates for UAE-based respondents, with typical surveys paying AED 5-50 depending on length and complexity.

Also read- Deadly Mobile App Development Mistakes Businesses Must Avoid in 2026

Top Online Earning Apps in UAE

Leading Platforms Dominating the Market

Let me share a snapshot of the app categories making waves in the UAE market:

| App Category | Primary Features | Average Earning Potential | User Base Demographics |

|---|---|---|---|

| Freelancing | Global client access, skill verification, secure payments, portfolio showcasing | AED 50-500/hour | Professionals 25-45, expats, skilled workers |

| Trading | Real-time market data, automated trading, educational resources, multi-asset support | Variable (investment-based) | Finance professionals, investors, entrepreneurs |

| Cashback | Retail partnerships, instant rewards, referral bonuses, tiered memberships | 2-25% per transaction | All demographics, shopping enthusiasts |

| Surveys | Flexible timing, multiple survey options, redemption variety, demographic targeting | AED 5-50/survey | Students, homemakers, part-time earners |

| Delivery & Ride-sharing | Flexible schedules, instant payments, route optimization, customer ratings | AED 3,000-12,000/month | Full-time and part-time drivers |

| Tutoring & Education | Video conferencing, content libraries, scheduling tools, payment processing | AED 75-300/hour | Educators, subject experts, language specialists |

Emerging Local Success Stories

The UAE has also fostered homegrown success stories—locally developed apps that understand the unique cultural and economic landscape of the region. These platforms often integrate Arabic language support, align with Islamic financial principles for Sharia-compliant earnings, accept local payment methods like Nol cards and telecom carrier billing, and understand local market dynamics and seasonal trends.

Local apps have the advantage of being built specifically for the UAE market rather than being international platforms adapted for the region. They understand that Friday and Saturday are weekend days, that Ramadan changes consumption and activity patterns dramatically, and that the summer months see different engagement levels as many residents travel. This cultural intelligence creates competitive advantages that generic global platforms struggle to replicate.

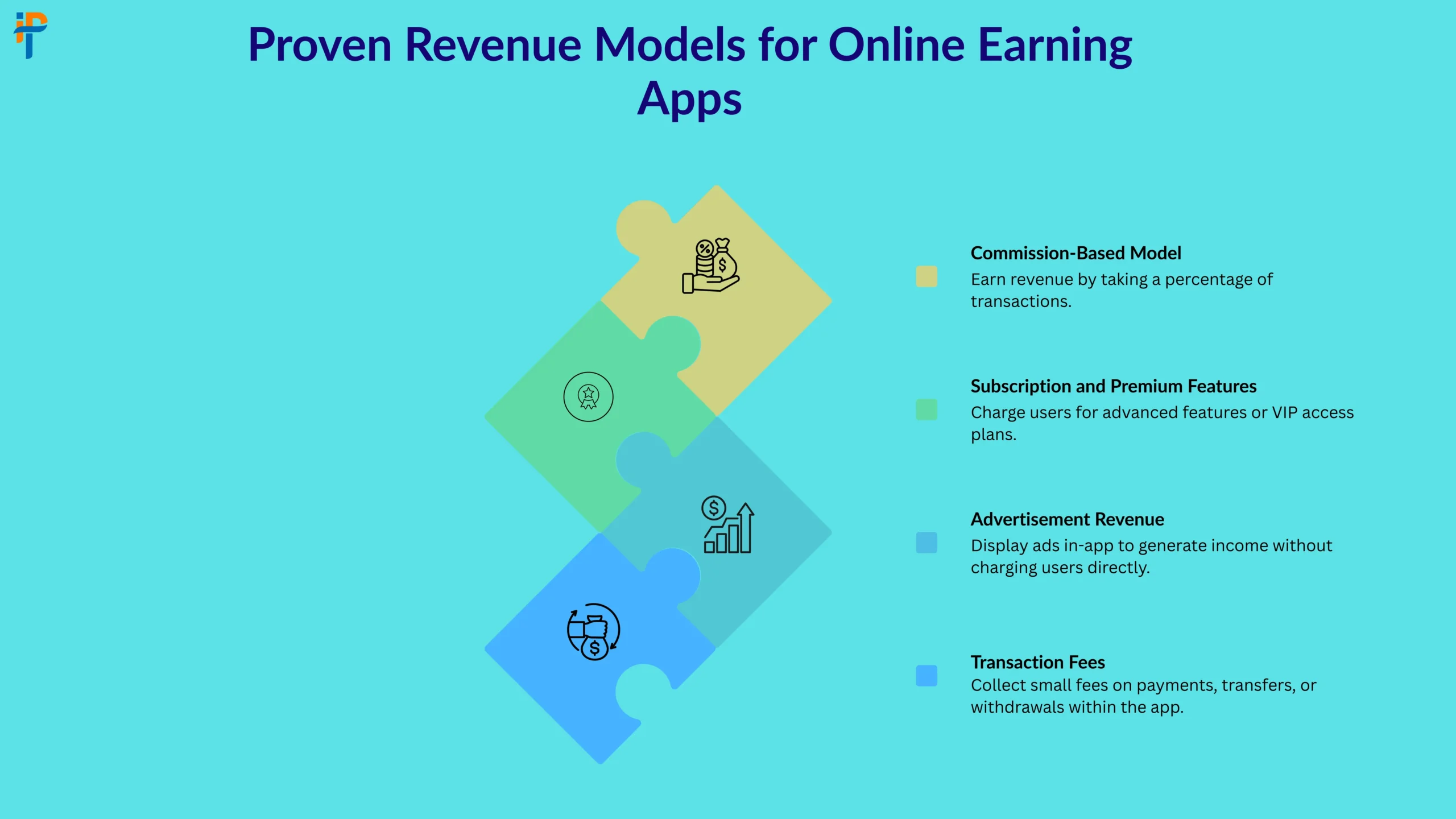

Proven Revenue Models for Online Earning Apps

Commission-Based Model

This model is beautifully simple: you facilitate transactions and take a percentage. Freelance platforms typically charge 10-20% commission on each transaction, creating sustainable revenue while providing value to both service providers and clients. The key? Ensure your commission structure feels fair—too high, and users abandon your platform; too low, and you can’t sustain operations.

The commission model works best when you’re providing genuine value beyond simple connection. Successful platforms justify their fees through dispute resolution services, secure payment escrow, quality assurance mechanisms, and marketing that brings clients to service providers. Users don’t mind paying commissions when they’re getting more opportunities than they could generate independently.

Subscription and Premium Features

The freemium model works exceptionally well for earning apps. Offer basic functionality for free to build your user base, then provide premium features—like advanced analytics, priority customer support, reduced commission rates, or unlimited job applications—for subscribers willing to pay monthly or annually. Think of it as creating a VIP lane that users actively want to access.

Subscription tiers let you serve different user segments effectively. A basic free tier attracts newcomers and casual users. A mid-tier subscription at AED 50-100 monthly appeals to serious users who want enhanced features. A premium tier at AED 200-300 monthly serves power users and professionals who depend on your platform for primary income. This tiered approach maximizes revenue while maintaining accessibility.

Advertisement Revenue

Strategic ad placement can generate substantial revenue without charging users directly. However, there’s an art to this approach. Bombard users with ads, and they’ll delete your app faster than you can say “monetization.” Integrate ads thoughtfully—native advertising that blends with content, sponsored listings that highlight relevant opportunities, reward-based videos where users opt-in for benefits, or banner ads placed non-intrusively.

In the UAE market, advertisement rates are generally higher than global averages due to the affluent demographic and competitive business environment. A well-designed ad strategy can generate AED 0.50-5.00 per user monthly, which compounds significantly with scale.

Transaction Fees

For payment-heavy platforms like investment or cashback apps, small transaction fees create predictable revenue streams. A 1-2% processing fee on withdrawals or transfers may seem minimal, but multiply that across thousands of daily transactions, and you’ve built a robust business model.

Transaction fees work best when they’re clearly communicated upfront and aligned with the value provided. Users accept withdrawal fees more readily when you offer instant transfers rather than waiting 3-5 business days. They understand currency conversion fees when you’re enabling international payments. Transparency prevents user frustration and builds trust.

Here’s a comparison of revenue model effectiveness:

| Revenue Model | Implementation Complexity | User Acceptance | Revenue Predictability | Scalability | Best For |

|---|---|---|---|---|---|

| Commission-Based | Medium | High | High | Excellent | Marketplaces, freelance platforms |

| Subscription | Low | Medium | Very High | Excellent | Premium services, professional tools |

| Advertisement | Low | Low-Medium | Medium | Good | High-traffic, free-to-use apps |

| Transaction Fees | Medium | High | High | Excellent | Payment platforms, investment apps |

| Hybrid Model | High | Medium-High | Very High | Excellent | Comprehensive platforms |

UAE Compliance, Payment Gateways & Legal Considerations for Earning Apps

Regulatory Framework in UAE

Navigating the UAE’s regulatory landscape isn’t optional—it’s essential. The Telecommunications and Digital Government Regulatory Authority oversees digital services, while financial apps must comply with Central Bank of UAE regulations and anti-money laundering directives established by the Financial Intelligence Unit.

If your app handles financial transactions, you’ll need proper licensing. The Economic Department in each emirate provides commercial licenses, but financial activities may require additional approvals from the UAE Central Bank or the Securities and Commodities Authority. Yes, it’s complex, but compliance protects both your business and your users.

Different business structures offer different advantages. Mainland companies can operate throughout the UAE and directly with government entities. Free zone companies benefit from 100% foreign ownership and tax exemptions but face restrictions on mainland business activities. The choice depends on your target market and operational requirements.

Payment Gateway Integration Options

Popular Payment Solutions in UAE

The UAE market demands diverse payment options. Successful earning apps integrate multiple gateways to accommodate user preferences:

- Credit and Debit Cards: All major cards including Visa, Mastercard, American Express, and local UAE cards must be supported for maximum accessibility.

- Digital Wallets: Apple Pay, Google Pay, Samsung Pay, and regional solutions like Etisalat Wallet and du Pay have gained significant traction, especially among younger demographics.

- Bank Transfers: Direct bank account integration for larger transactions, offering lower fees but requiring stronger verification processes.

- Cryptocurrency Options: For forward-thinking platforms, supporting Bitcoin, Ethereum, and stablecoins appeals to tech-savvy users, though regulatory compliance requires careful navigation.

- Cash-on-Delivery Alternatives: For certain business models, integrating with payment-on-delivery services maintains accessibility for users without bank accounts or credit cards.

Each gateway comes with unique fee structures ranging from 2.5% to 4.5% per transaction, settlement periods between instant to 5 business days, and supported currencies. Your choice should align with your target audience’s preferences and your business requirements.

Data Protection and Privacy Laws

The UAE’s data protection regulations have strengthened significantly, with frameworks aligned to international standards. Your earning app must implement robust data encryption using AES-256 or equivalent standards, secure explicit user consent for data collection and processing, provide transparent privacy policies in both English and Arabic, and enable users to access, modify, or delete their personal information upon request.

Data breaches aren’t just embarrassing—they’re potentially business-ending in today’s privacy-conscious environment. Beyond legal penalties, the reputational damage can destroy user trust that took years to build. Implementing security-first architecture from day one isn’t an expense; it’s an investment in your platform’s longevity.

Consider appointing a Data Protection Officer, especially if you’re processing significant volumes of personal data. Conduct regular security audits and penetration testing. Maintain comprehensive incident response plans. These practices demonstrate commitment to user privacy and position your platform as trustworthy in a market where trust is currency.

Also read- Top 8 Reasons Startups Choose Custom Software Development

AI-Powered & Scalable Online Earning App Development Approach by IPH Technologies

Artificial Intelligence Integration

At IPH Technologies, we don’t just build apps—we create intelligent platforms that evolve with your users. Our AI-powered approach includes:

Machine learning algorithms for personalized earning recommendations Fraud detection systems that protect platform integrity Chatbots providing 24/7 user support in multiple languages Predictive analytics forecasting user behavior and platform growth patterns

Imagine an earning app that learns your users’ preferences and proactively suggests opportunities matching their skills and availability. A freelance designer logs in and immediately sees curated project listings matching their portfolio style. A survey app user receives notifications about high-paying surveys matching their demographic profile during their typical active hours. That’s not science fiction—that’s our standard development approach.

Our AI systems continuously improve through usage, identifying patterns invisible to human analysis. They detect fraudulent activity before it impacts legitimate users, optimize task allocation to maximize completion rates, and personalize user experiences to boost engagement and retention. In the competitive UAE market, this intelligence layer transforms good apps into indispensable platforms.

Scalability Architecture

What happens when your app goes viral and suddenly 10,000 new users register in a single day? With our scalable architecture, absolutely nothing—in the best way possible. We design systems using:

Microservices architecture for independent scaling of different application components Cloud-native solutions that automatically grow with demand Load balancing ensuring consistent performance across server clusters Database optimization for lightning-fast queries even with millions of records

Our architecture separates concerns intelligently. The user authentication service scales independently from the payment processing service. If your referral program goes viral on social media, user registration can handle the surge without impacting existing users’ transactions. This modular approach provides resilience and efficiency that monolithic architectures simply can’t match.

We implement horizontal scaling strategies that add resources automatically when traffic increases and reduce them when demand subsides. You pay only for what you need while maintaining the capacity to handle unexpected growth. This elasticity is crucial in markets like the UAE where user acquisition can accelerate rapidly through influencer partnerships or viral marketing campaigns.

Cloud Infrastructure Solutions

We leverage industry-leading cloud platforms—AWS, Google Cloud, and Microsoft Azure—to provide your earning app with:

Global reach with content delivery networks placing data closer to users 99.9% uptime guarantees ensuring your platform is always accessible Automated backup and disaster recovery protecting against data loss Cost-efficient resource allocation optimizing infrastructure spending

Your infrastructure should empower growth, not limit it. Our cloud-based approach means you’re never constrained by physical server capacity. Need to expand from the UAE to other GCC countries? We deploy additional regional servers within hours. Want to add new features requiring significant computational power? We spin up specialized instances without disrupting existing services.

Cloud infrastructure also provides security benefits through enterprise-grade firewalls, DDoS protection, regular security patching, and compliance certifications meeting international standards. These security layers would cost millions to implement independently but come standard with professional cloud deployments.

Also read- Step-by-Step Guide to Building a Successful Mobile App in 2026

Essential Features of a Successful Online Earning App

User Authentication and Security

Security isn’t a feature—it’s the foundation. Our development approach includes:

Multi-factor authentication requiring both passwords and verification codes Biometric login options leveraging fingerprint and face recognition End-to-end encryption for sensitive data protecting user information Regular security audits and penetration testing identifying vulnerabilities before malicious actors do

Think of security as the invisible shield protecting your users’ earnings and personal information. Every user who entrusts your platform with their financial data or personal details is placing faith in your security measures. Betraying that trust—even unintentionally through inadequate security—destroys your reputation irreparably.

We implement industry-standard protocols like OAuth 2.0 for authentication and SSL/TLS for data transmission. Sensitive information like passwords undergoes salted hashing using algorithms like bcrypt. Financial data receives additional encryption layers. These technical implementations might be invisible to users, but they’re the difference between a secure platform and a data breach waiting to happen.

Multi-Payment Options

Flexibility is king in payment preferences. Successful earning apps support:

Bank transfers with IBAN integration for local UAE banks Digital wallets including Apple Pay, Google Pay, and regional options Cryptocurrency options for forward-thinking users seeking alternatives Instant withdrawal capabilities improving user satisfaction

The easier you make it for users to access their earnings, the more loyal they become. Nobody wants money trapped in an app for weeks waiting for bank transfer processing. Offering multiple withdrawal options—even if some carry small fees—gives users control over their funds.

Consider the psychology of payment timing. Users who can withdraw earnings instantly feel more in control and satisfied than those waiting days for processing. Even if instant withdrawal carries a 2% fee while standard withdrawal is free, many users happily pay for immediacy. This preference is especially pronounced in the UAE where instant gratification and premium services command market share.

Real-Time Analytics Dashboard

Both users and administrators need visibility into platform performance. Our dashboards provide:

Earning history and trends showing income patterns over time Performance metrics and goal tracking helping users optimize their activities Detailed transaction records supporting financial planning and tax purposes Exportable reports in formats like PDF and Excel for external use

Transparency builds trust, and trust builds long-term user relationships. When users can see exactly how they’re earning, which activities generate the best returns, and how they’re progressing toward goals, they feel empowered and invested in the platform’s success.

For platform administrators, analytics provide crucial insights into user behavior, feature adoption, revenue generation, and potential problems. Real-time monitoring lets you identify and address issues before they escalate. You can spot trending opportunities and double down on successful features while identifying underperforming elements for improvement or removal.

Gamification Elements

Let’s face it—earning money is great, but earning money while having fun is even better. We integrate:

Achievement badges and milestones celebrating user accomplishments Leaderboards fostering friendly competition among users Streak bonuses encouraging daily engagement and habit formation Referral programs with progressive rewards creating viral growth loops

Gamification transforms mundane tasks into engaging experiences that keep users coming back. A freelancer might push to complete one more project to unlock a “100 Jobs Completed” badge. A survey taker returns daily to maintain their response streak that unlocks bonus opportunities. These psychological triggers are powerful retention mechanisms.

The UAE market particularly responds to gamification because of its young, digitally-native demographic. Users accustomed to gaming mechanics in entertainment apps expect similar engagement in productivity and earning apps. Meeting this expectation differentiates your platform from competitors stuck in purely transactional mindsets.

Also read- Machine Learning Mobile Apps: Boost User Experience 2026

Cost-Effective & Custom Online Earning App Development Strategy

Development Timeline and Phases

Creating a successful earning app isn’t a sprint—it’s a strategic marathon. Here’s our typical development roadmap:

Discovery & Planning

We immerse ourselves in your vision, conducting comprehensive market research, defining core features and user journeys, creating detailed wireframes and user flow diagrams, and establishing technical architecture and technology stack.

Design & Prototyping

Our design team crafts intuitive interfaces with user experience testing through clickable prototypes, brand integration ensuring visual consistency, accessibility compliance meeting WCAG standards, and interactive prototypes for stakeholder feedback and refinement.

Development

Backend and frontend development happen in parallel using agile sprints, with payment gateway integration and testing, security implementation and vulnerability assessment, API development for third-party integrations, and continuous testing throughout each sprint cycle.

Testing & Quality Assurance (2–3 weeks)

Rigorous testing across functionality verification ensuring all features work as designed, performance testing under load simulating thousands of concurrent users, security testing including penetration testing and vulnerability scanning, and compatibility testing across devices, operating systems, and screen sizes.

Deployment & Launch (1–2 weeks)

App store submission for iOS and Android, server configuration and deployment, monitoring and analytics setup, and initial user onboarding and support.

Post-Launch Optimization (Ongoing)

Bug fixing and performance improvements, feature enhancements based on user feedback, scaling infrastructure as user base grows, and continuous security updates and compliance maintenance.

Technology Stack Selection

We select technologies based on your specific requirements, but our typical stack includes:

Mobile Development: React Native or Flutter for cross-platform development, enabling code reuse across iOS and Android while maintaining native performance and user experience.

Backend Services: Node.js for real-time applications requiring high concurrency, Python/Django for data-heavy applications with complex business logic, or Ruby on Rails for rapid development of feature-rich platforms.

Database Management: PostgreSQL for structured data requiring complex queries and relationships, MongoDB for flexible schema and rapid iteration, or Redis for caching and session management improving performance.

Cloud Infrastructure: AWS for comprehensive service ecosystem and global reach, Google Cloud for AI/ML capabilities and analytics, or Microsoft Azure for enterprise integration and hybrid solutions.

Payment Processing: Stripe for developer-friendly international payments, PayPal for global brand recognition, or regional solutions like Network International for UAE-specific optimization.

The right technology stack balances current needs with future scalability, developer availability with long-term maintainability, and cutting-edge capabilities with proven stability.

Cost Optimization Techniques

Quality doesn’t have to break the bank. Our cost-effective strategies include:

MVP (Minimum Viable Product) Approach: Launch with core features that validate your concept before investing in comprehensive functionality. This reduces initial development costs by 40–60% while getting your app to market faster.

Reusable Component Libraries: We maintain extensive libraries of pre-built components—authentication systems, payment integrations, admin dashboards—that accelerate development and reduce costs through code reuse.

Automated Testing: Implementing automated test suites reduces quality assurance time and costs while improving reliability. Initial investment in test automation pays dividends throughout the development lifecycle and ongoing maintenance.

Phased Feature Rollout: Spreading investment over time by launching with essential features and adding advanced capabilities based on user feedback and revenue generation. This approach aligns spending with actual user needs rather than assumptions.

Cloud Cost Optimization: Using auto-scaling, serverless functions for variable workloads, and spot instances for non-critical processes reduces infrastructure costs by 30–50% compared to traditional always-on server approaches.

We’ve helped clients launch earning apps with budgets ranging from AED 150,000 to AED 500,000+, depending on complexity, features, and integration requirements. The key is aligning investment with business objectives and market opportunity.

Also read – Native vs Cross Platform App Development: 2026 Guide

Why Choose IPH Technologies for Online Earning App Development

Proven Track Record

Numbers tell stories, and our story is impressive: over 500 successfully delivered projects spanning mobile apps, web applications, and custom software solutions, 430+ satisfied clients across finance, healthcare, e-commerce, education, and earning platforms, and extensive experience in UAE market dynamics, regulatory requirements, and user preferences.

Our portfolio includes earning apps that have processed millions in transactions, platforms serving tens of thousands of active users, and solutions that have helped clients achieve their business objectives and generate substantial revenue. We don’t just build apps—we build businesses.

What sets IPH Technologies apart is our holistic approach to app development. We’re not just coders executing specifications; we’re strategic partners invested in your success. We challenge assumptions, suggest improvements, and bring insights from hundreds of previous projects to every engagement.

Agile Development Methodology

We embrace agile development principles that keep projects on track, on budget, and aligned with your vision. Our approach includes two-week sprint cycles delivering tangible progress regularly, daily standups ensuring team alignment and rapid problem resolution, sprint reviews and demos providing transparency and gathering feedback, and continuous integration and deployment enabling rapid iteration.

Agile methodology particularly benefits earning app development because requirements often evolve as you learn more about your market and users. Traditional waterfall approaches lock you into specifications defined months earlier, but agile embraces change and incorporates learning throughout development.

You’re never surprised by what you’re getting. Every two weeks, you see working software demonstrating progress. You can test features, gather user feedback, and adjust priorities based on real-world learning rather than theoretical plans. This transparency builds confidence and ensures the final product exceeds expectations.

Post-Launch Support and Maintenance

Our commitment doesn’t end at launch—that’s when the real work begins. We provide comprehensive post-launch support including 24/7 monitoring and incident response ensuring uptime and performance, regular updates and security patches maintaining platform security, feature enhancements and optimization based on user analytics, and scaling support as your user base grows.

Think of us as your extended technology team. As your app grows and evolves, we’re there providing expertise, resources, and support. Whether you need to add new payment gateways, integrate with third-party services, or scale infrastructure for viral growth, we’ve got you covered.

We also provide training and documentation ensuring your team can manage day-to-day operations independently. Our goal is to empower you, not create dependency. However, we’re always available when you need specialized expertise or additional development capacity.

Also read – Low-Code No-Code Automation Transform Business Processes in 2026

Conclusion: Build a Future-Ready Online Earning App in UAE

The online earning app market in the UAE represents one of the most exciting opportunities in today’s digital economy. With favorable demographics, world-class infrastructure, progressive regulations, and a population eager for flexible income opportunities, the conditions for success have never been better.

However, success requires more than just a good idea. It demands deep understanding of the UAE market, technical excellence in app development, a strategic approach to monetization and growth, and an unwavering commitment to user experience and security.

At IPH Technologies, we bring all these elements together with over 500 successfully delivered projects, proven expertise in earning app development, comprehensive understanding of UAE compliance and regulations, and cutting-edge technology implementation. We don’t just build apps—we build platforms that transform ideas into sustainable businesses.

Whether you’re launching your first earning app or scaling an existing platform, the journey begins with choosing the right development partner—one who understands not just code and design, but business strategy, market dynamics, and user psychology. One who’s committed to your success as much as their own.

The future of earning is digital, mobile, and accessible. The question isn’t whether to build an earning app—it’s whether you’re ready to seize the opportunity before your competition does. With IPH Technologies as your partner, you’re not just building an app; you’re building the future of work in the UAE.

Ready to turn your vision into reality? Let’s create something extraordinary together.

.png)